Summary

TransferWise is an online service that allows users to send money across borders. It’s known for its no-nonsense approach to international money transfers. The company’s unique approach to money transfer and monex exchange involves cutting out the middle man in the transaction. As such, they’re able to charge significantly less for their services.

In this TransferVise review, we’re going to take a look at the service and find out how it fairs with other similar services.

About the Company

TransferWise currently stands as the biggest money transfer company throughout the UK. It was founded in London back in 2011 and has experienced massive growth since then. The company prides itself on having excellent exchange rates in addition to a transparent fee structure. Apart from that, its online system is fairly easy to use, thus the reason why a lot of users are satisfied with the service.

To add to that, it even has its own mobile app which you can download on the App Store and Google Playstore.

Services Offered

With TransferWise, you can send money to a lot of countries around the world. What makes it different from other similar services is that the rates are a whole lot cheaper. This means you’ll be able to save even more money and even avoid the unfair exchange rates imposed by banks.

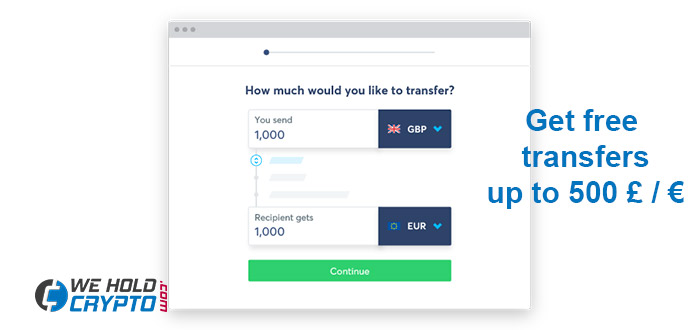

With our promo link, you can get a free transfers up to 500 GBP / EUR. For more information click on the button below.

Aside from that, you also have to option to create your own online money wallet by downloading the TransferWise mobile app. You can also get your own free debit card which you can use on a lot of transactions. Click here to get

Fees

TransferWise’s fees are very low and transparent compared to other services. You will be charged a percentage of the transfer amount as well as a flat fee depending on the country you’re sending the money. The minimum fees you have to cover will depend on the specific currency you’re sending from and to.

For example, if you’re transferring pound sterling to euro, you’ll have to pay 80p and 0.35% of your transfer amount. Therefore, if you want to transfer £1000 into euros via bank transfer, you’ll have to pay £4.29.

Conclusion

Ever since it was founded in 2011, TransferWise has definitely made a huge name in the market. As of now, it’s regarded as one of the highest valued startups in the UK. Besides, it’s funded by Peter Thiel, PayPal’s co-founder, so you can expect it to be completely safe to use.

That aside, TransferWise really sets itself apart from other services due to its relatively low fees and complete transparency. For most people, it can be the best money wallet service they can use, especially when transferring money abroad. It’s very easy to use, offers full transparency of their fees and costs, and charges very little for your transactions.

However, it does fall short when it comes to its customer support. Still, if you want to transfer money without having to pay ridiculous fees, then TransferWise is your best option.

Buy crypto, gold and stocks in secondsCheck out our Revolut review with information how you can buy crypto, stocks or commodities for free!

Buy crypto, gold and stocks in secondsCheck out our Revolut review with information how you can buy crypto, stocks or commodities for free!